Car Insurance

9000+ Cashless

Network Garages

96% Claim

Settlement (FY23-24)

24*7 Claims

Support

Click here for new car

I agree to the Terms & Conditions

9000+ Cashless

Network Garages

96% Claim

Settlement (FY23-24)

24*7 Claims

Support

Click here for new car

I agree to the Terms & Conditions

To hit the road with peace of mind, protect your car by getting a car insurance policy. The best part is that you can customize your IDV yourself, along with 11 beneficial add-ons to suit your car.

So, whether you want to buy/renew a car insurance by Digit or make a claim, everything can be done online with our quick and simple smartphone-enabled processes.

Car Insurance, also known as auto or motor insurance, is a type of vehicle insurance policy that protects you and your car from any risks and damages caused from accidents, thefts or natural disasters.

So, you will be financially secure in case of any losses that may be incurred because of any such unforeseen circumstances. In addition to that, you will also be protected from third-party liabilities.

Whether you want to just legally comply with the law with the most basic, third party car insurance, or give your car ultimate protection with a comprehensive car insurance or own damage policy, Digit offers you a third-party, comprehensive and own damage car insurance at affordable premiums online.

The best part? You can customize your IDV yourself, along with 11 beneficial add-ons to suit your car. So, whether you want to buy/renew a car insurance by Digit or make a claim- everything can be done online with our quick and simple smartphone-enabled processes.

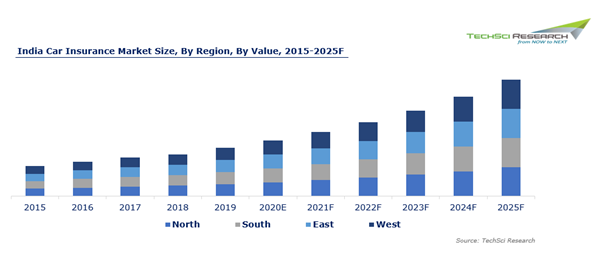

The average cost of car insurance in India is influenced by various factors including the type of vehicle, location, age of the car, driving record, type of insurance bought, etc. So, here are some important statistics for car insurance in India:

Car insurance is your financial airbag and is also mandatory by law in India. Here are other reasons why getting a car insurance policy is important:

Whether you go for a third-party car insurance or comprehensive car insurance, having a car insurance can benefit you by saving you from paying huge amounts in case of damages and losses caused during an accident, a natural calamity, fire, theft and other such unforeseen circumstances. Additionally, you can also protect yourself from hefty traffic fines!

Accidents happen to everyone. In case you end up in a situation where you’ve accidentally hit someone, a car or someone’s property, your car insurance will be there for you to cover for the damages and losses incurred to the third-party, so you don’t need to spend hours arguing or fighting over it!

If you opt for comprehensive car insurance, you can benefit further by getting better coverage for your car using add-ons like the zero-depreciation cover, return to invoice cover, consumables cover, and breakdown assistance, amongst others.

As per the Motor Vehicles Act, all cars must have at least third-party car insurance. Without one, you will be liable to pay a penalty of ₹2,000 for the first offence and ₹4,000 for the second time.

With Digit, technology makes everything a breeze. From buying car insurance to making claims, it’s all done online in just a few minutes saving you both time and money. Our process is so straightforward, it’ll have you saying, "That's it?"

It is equally important to know what’s not covered in your car insurance policy, so that there are no surprises when you make a claim. Here are some such situations:

Car insurance add-ons which you can buy with your car insurance policy

We treat our customers like VIPs, know how…

|

Damages/Losses to own car due to an accident |

×

|

✔

|

✔

|

|

Damages/Losses to own car in case of fire |

×

|

✔

|

✔

|

|

Damages/Losses to own car in case of a natural calamity |

×

|

✔

|

✔

|

|

Damages to Third-Party Vehicle |

✔

|

✔

|

×

|

|

Damages to Third-Party Property |

✔

|

✔

|

×

|

|

Personal Accident Cover |

✔

|

✔

|

×

|

|

Injuries/Death of a Third-Party Person |

✔

|

✔

|

×

|

|

Theft of your car |

×

|

✔

|

✔

|

|

Customize your IDV |

×

|

✔

|

✔

|

|

Extra protection with customized add-ons |

×

|

✔

|

✔

|

Know more about the difference between comprehensive and third party insurance

|

Key Features |

Digit Benefit |

|

Premium |

Starting from ₹2094 |

|

No Claim Bonus |

Up to 50% Discount |

|

Customizable Add-Ons |

11 Add-ons available |

|

Cashless Repairs |

Available at 6000+ Garages with Doorstep Pickup & Drop |

|

Claim Process |

Smartphone-enabled Claim process. Can be done online within 7 minutes! |

|

Own Damage Cover |

Available |

|

Damages to Third-Party |

Unlimited Liability for Personal Damages, Up to 7.5 Lakhs for Property/Vehicle Damages |

On the Digit app or website, enter car’s registration number and mobile number, and click on ‘View Prices’.

Select the plan, add-ons and IDV, and click on ‘Continue.’

Enter your personal, nominee and vehicle details and click on ‘Pay Now.’

Complete the payment and mandatory KYC verification process.

You’re done! You’ll receive the policy document via email, SMS and WhatsApp. Also, you can access it 24X7 on the Digit App.

While buying a new car insurance policy online from Digit, you don’t need a load of documents or paperwork. By having the following documents handy, you can easily buy a new car insurance policy within minutes:

After you buy or renew our car insurance plan, you live tension free as we have a 3-step, completely digital claims process!

Just call on 1800-258-5956. No forms to be filled

Get a link for Self-Inspection on your registered mobile number. Shoot your vehicle’s damages from your smartphone through a guided step by step process.

Choose the mode of repair you wish to opt for i.e. Reimbursement or Cashless through our network of garages.

Forget about the waiting game for surveyors. With our innovative smartphone-enabled self-inspection process, you can assess damages in just 7 minutes, That's It! No more delays or uncertainties, just swift solutions at your fingertips.

When accidents or natural calamities strike, worrying about repair costs is the last thing you need. That's why we offer Cashless Claims at over 9500+ garages across India. Get your car fixed without upfront expenses, That's It! Focus on what truly matters while we handle the rest.

Embracing a digital, paperless approach, with our user-friendly app, paperwork becomes a thing of the past. With Digit no claim forms are required, simply upload everything online, That's It! Your job is done.

Get cashless repairs at 6000+ garages across India

Here’s what you need to do to avoid car insurance claim rejections:

To download your renewed or already active car insurance policy with Digit, follow the given steps:

A Third-Party Car Insurance Premium Calculator depends on your car’s engine cc and even the respective premium rates are predetermined by the IRDAI, which are as follows:

|

Private Cars with Engine Capacity |

The premium for 2019-20 in INR |

New 4W TP rate (effective 1st June 2022) |

|

Not Exceeding 1000 cc |

₹2072 |

₹2094 |

|

Exceeding 1000 cc but not exceeding 1500 cc |

₹3221 |

₹3416 |

|

Exceeding 1500 cc |

₹7890 |

₹7897 |

Here are car insurance premium prices for private electric cars, which are based on factors like kilowatt capacity, make, model, and age.

Note: Long term policy means 3-year policy for new private cars (Source IRDAI). The premium numbers mentioned here may vary as per vehicle, please check the premium before you buy the policy.

|

Vehicle kilowatt capacity (KW) |

Premium rate for one-year third-party policy |

Premium rate for long-term policy* |

|

Not exceeding 30 KW |

₹1,780 |

₹5,543 |

|

Exceeding 30KW but not exceeding 65KW |

₹2,904 |

₹9,044 |

|

Exceeding 65KW |

₹6,712 |

₹20,907 |

Insured Declared Value (IDV) is the market value of the car. This IDV is adjusted for depreciation value of your car as per the below table.

This age-wise depreciation is applicable for only Total Loss/Constructive Total Loss (TL/CTL) claims.

|

Vehicle Age |

Depreciation Rate |

|

Not Exceeding 6 months |

5% |

|

Exceeding 6 months but not exceeding 1 year |

15% |

|

Exceeding 1 year but not exceeding 2 years |

20% |

|

Exceeding 2 years but not exceeding 3 years |

30% |

|

Exceeding 3 years but not exceeding 4 years |

40% |

|

Exceeding 4 years but not exceeding 5 years |

50% |

It doesn’t matter whether your old car insurance policy was with us or not, choosing Digit for Car Insurance renewal is easy and hassle-free and can be done within minutes online.

Looking to renew your car insurance policy with us for the first time? Here are some benefits to look forward to:

Everyone’s primary objective of buying a car insurance is so that they can get their claims done easily during times of need. Luckily, with all our processes everything from making a claim to assessing car damages can be done online.

The last thing you want to do at the time of an accident is spend unnecessarily from your pocket. That’s why we offer the option of cashless repair, where you can just drop by at any of our network garages and get your claimed repairs done without any extra money spent.

You can avail cashless services only at our network garages but lucky for you, we have 9000+ cashless garages spread across the country that you can choose from.

As and when the need arises, such as if your car can’t be repaired in time, we offer our pickup and drop services, so you don’t have to worry about the logistics.

So, that no matter what time or day it is, we’ll always have your back.

Don’t let anyone fool you into low premiums and even lower IDVs that can instantly affect the money you’d be liable to receive during claims. That’s why, at Digit we believe in transparency as we let YOU customize your IDV as required.

Login to Digit App or website and go to the ‘My Policy’ section.

Select the policy pending for renewal and click on ‘Renew Policy.’

Next, select the IDV, add-ons and confirm the details, then click on ‘Pay Now.’

You’re done! You’ll receive the policy document via email, SMS and WhatsApp. Also, you can access it 24X7 on the Digit App.

Buying a luxury car is a one-time deal for most owners, thus, you must protect it with comprehensive car insurance to cover both third-party liability and own damage. Appropriate add-ons for luxurious cars are necessary too.

You can get a Zero Depreciation Cover to claim the full value of repairing/replacing its expensive parts. A Return to Invoice Cover will be useful for luxury cars as it ensures that you receive the original invoice value of your car in case of theft or total loss.

An Engine Protection Cover is a must for luxury car since it is an expensive component of the car, and this cover will protect you against all engine and gearbox repairs. Also, it's better to get a consumables cover to cover the replacements cost of lubricants, oils, nuts, bolts, screws, washers, grease, etc.

Most car owners tend to ignore the importance of car insurance if you have a 7-year-old car; however, having at least third-party insurance is mandatory from the legal perspective. Since your car is already 7 years old, it is advisable to have own-damage cover to get coverage for repairs or replacement of your car in case of accidents, theft, fire, natural calamities, etc.

Also, getting a comprehensive cover with add-ons like a Roadside Assistance add-on will safeguard you on long road trips if your car breaks down, has a flat tyre or requires towing.

People keep some things solely for the emotional value attached to them like that car in your family for generations, which is rarely driven but still requires to be insured via at least a third-party coverage policy as per legal requirements. Since you do not drive that car around, you can skip purchasing other add-ons.

Here’s what you should look for to pick the right car insurance for your car:

IDV is the maximum amount your insurance provider can give you, in case your car is stolen or totally damaged.

The Insured Declared Value and your car insurance premium go hand in hand. This means, the higher your IDV is, the higher your car insurance premium – and as your vehicle ages and IDV depreciates, your premium also decreases.

Also, when you decide to sell your car, a higher IDV means you’ll get a higher price for it. Price may also be affected by other factors like usage, past car insurance claims experience etc.

So, when you’re choosing the right car insurance policy for your car, remember to make note of the IDV being offered, and not just the premium.

A company offering a low premium may be tempting, but this could be because the IDV on offer is low. In case of a total loss of your car, a higher IDV leads to higher compensation.

At the time of resale, your IDV is indicative of the market value for your car. However, if you have maintained your car really well and is shining as good as new, you can always aim at a price more than what your IDV might offer you.

At the end of the day, it all boils down to how much love you have showered on your car.

Know more about Insured Declared Value in Car Insurance.

What is NCB in car insurance: NCB is a discount on premium given to the policyholder for having a claim free policy term.

A no claims bonus ranges from a discount of 20-50% and is something you earn at the end of your policy period by maintaining a record of making no car accident claims under your car insurance policy.

This means that you can’t get a no claims bonus when you buy your first comprehensive car insurance policy – you can only get it on your policy renewal. Your no claims bonus increases after every claim-free year on your policy renewal.

For example, you can earn a 20% NCB after the first year of having no claim under your car insurance policy. This percentage will increase with every claim-free year, reaching 50% after 5 years – and resetting to zero when you make a claim.

After reaching 50% in the 5th year, your NCB stops rising and remains the same. This is called the No Claim Bonus Sunset Clause.

A No Claim Bonus is meant for the car insurance policyholder regardless of the car. This means, even if you switch your car, your NCB stays with you.

If you decide to buy a new car, you will be issued a new car insurance policy, but you can still avail of the NCB you accumulated on the old car or policy.

A Bumper-bumper or Zero dep cover or Parts Depreciation Cover, makes sense for cars less than 5 years old. Like everything in life, there is a decrease in value of certain parts of your car, including the bumper or any other metal or fibre glass parts.

So, when a damage happens, the full cost of replacement is not given as depreciation is deducted from the claim money. But this add-on makes sure there is Zero Depreciation and you get the full value of the cost of repair/replacement provided.

In short, if your car is partially damaged, you don’t have to bear the amount being calculated for depreciation and your insurer will take care of everything.

Know more about:

If you opt to get your car repaired with a Digit Authorized Repair Center, we will make the payment for the approved claim amount, directly to the Repair Center. This is a Cashless Claim.

Please note, if there are any deductibles, like a Compulsory Excess/ Deductible, any repair charges for which your insurance doesn’t cover you or any depreciation costs, that is to be paid by the insured’s own pocket.

Know more about Cashless Car Insurance.

To help you understand and customize your car insurance premium better, we’ve given you the option calculate your car insurance premium yourself using this car insurance calculator.

What decides your car insurance premium? You can notice this in your car insurance premium calculator too. The factors affecting your premium include:

Type of Car Insurance Policy - The coverage and benefits provided by your car insurance policy influence your car insurance premium. So, if you choose a comprehensive policy over a third-party policy, your premium would be higher as it offers much greater coverage than the latter.

Your Car’s IDV - The Insured Declared Value (IDV) is your car’s current market value after deducting the depreciation charges. If your IDV increases, so will the insurance premium.

Add-Ons Opted - A customised insurance policy with different car insurance add-on covers to fulfil your crucial insurance requirements and protect your car in all situations will fetch you a higher premium.

Deductibles - Deductibles in car insurance mean the predetermined amount that the policyholder needs to pay from their pocket before the insurer pays the rest of the claim amount. So, you can opt for a higher voluntary deductible for a lower premium because the insurer will have to pay less during claim settlement.

No Claim Bonus - If you do not raise any claim in a policy year, the insurer will reward you with a discount on your next policy renewal premium in the form of a No Claim Bonus.

Make & Model of your Car - The car insurance premium is subject to change depending on the manufacturer and model of your car. Insuring a luxurious sedan will attract a higher premium than a standard hatchback. Further, the cubic capacity of the car’s engine and its fuel efficiency also directly impact the car insurance premium.

Age of your Car - Since the value of your car reduces with each passing year due to normal wear and tear of its parts, the IDV also falls, and hence the policy premium also decreases. It implies that insurance premiums are higher for a brand-new car and less for an old car.

Know more about How to Calculate the Car Insurance Premium

Make sure your car insurance company is giving you the right information on the below.

Learn more about the Right Way to Compare Car Insurance Quotes.

It’s a great thing to compare your car insurance quotes before buying. But make sure you’re comparing them on the below parameters. What do people usually look for while renewing their car insurance?

But what should you actually look for while renewing your car insurance?

Unfortunately, when it comes to supposedly mundane things like a car insurance, people tend to ignore or forget about it unless there’s a repercussion of not having one.

However, more often than not- these guidelines are made for the overall safety of people like you and me.

Let’s take for example; what if a Third-Party Car Insurance wasn’t mandatory by law. In this case, most people wouldn’t even have one and in case of an accident, both affected parties would drown in baseless arguments and of course, tons of expenses!

Therefore, while the primary objective of a car insurance is to protect an affected party during a mishap or accident, there is more than one reason why a car insurance has been made mandatory in India.

Road accidents are extremely common in India and one of the main reasons the Motor Vehicle Act has made car insurances mandatory is due to the same.

In 2017, there were more than 1200 injuries reported on a daily basis due to road accidents! A car insurance would ensure no one has to bear the financial brunt in such a situation.

Whether you bump into someone’s vehicle or a car hits your dear car, having at least a third-party car insurance in place will ensure that the affected third-party will be compensated for in cases of car damages or, personal damages.

When an accident happens, more than the damages – it is the legal process that takes one’s time and energy. However, when you have a valid car insurance, legal processes too are taken care of.

Know more about Why Car Insurance is Mandatory in India?

When’s the last time you made the effort to pay your electricity bill at your registered center or, when was the last time you went to your kirana shop to get your mobile recharge done? It’s been a while, hasn’t it?

Thanks to the power of the internet, most of us now use the internet to get most things done. Pay bills, recharge and now, even order groceries! Naturally, technology has also progressed in such a way that we need not visit insurance agents or get in touch with our dealers to get our car insurance anymore.

Now, you can simply buy your car insurance online 😊 All you need is your basic car details and your debit/credit card to process your premium and that’s it, your car insurance policy will be emailed to you within minutes.

Here’s why buying car insurance online makes more sense than buying it offline:

|

Buying Car Insurance Online |

Buying Car Insurance Offline |

|

It can save you so much time. You need not waste your time waiting or visiting someone to get the job done. |

It requires more time commitment as you need to physically visit the insurer’s office. |

|

Can be bought from the comfort of your home. |

Need to probably stand in queues at the insurer’s office to buy the policy. |

|

Allows you to customize your car insurance policy yourself. |

You need to talk to the insurance agent or the company for the same. |

|

More transparent as it is a firsthand process. |

You need to rely on a third-party person to do it for you. |

|

Absolutely no paperwork involved! |

Loads of paperwork to keep track of. |

|

Easy renewal process as the policyholder’s details are already saved in the system. |

Typically, a lengthy and tiresome claim process. |

Whether you’ve just purchased a brand-new or second-hand car, a car insurance policy can be bought for any of them.

However, while purchasing your second-hand car check if the owner already has a valid car insurance and get the same transferred to your name, well within 14 days of purchase. Additionally, while insuring your second-hand car, you need to make sure:

Know more about Second hand Car Insurance

Whether you’ve just bought an old, second-hand car or have realized you don’t have a car insurance for your current car yet; you can instantly insure the same on our website.

However, here are three important things to keep in mind before buying a car insurance online for your old car:

There are essentially two kinds of car insurances; Third-Party and Comprehensive Car Insurance. Although we generally recommend getting a Comprehensive Car Insurance for maximum benefits, you could also go for a Third-Party Insurance if you’re not going to use the car much or are going to discard it soon. In this situation, a Third-Party Car Insurance could make sense as it at least fulfils your car’s legal responsibility.

The IDV, i.e. Insured Declared Value is the market value of your car. Since your car is old, the IDV too would be low (you can customize this accordingly on our website while buying a car insurance online) due to the depreciation over time, depending on how old it is.

The IDV directly affects your premium and sum insured. While the premium will be low, the sum insured too would be low at the time of a claim.

Add-ons are what you can opt for while buying a car insurance for your old car online. However, this only applies when you’re purchasing a Comprehensive/Standard car insurance policy.

These help you and your car with maximum coverages and benefits such as; tyre protect, gearbox and engine protection, return to invoice, etc. However, since you’re planning to buy a car insurance for an old car, see which add-ons would be applicable or not.

For example; A Zero Depreciation or Bumper to Bumper cover may not be applicable if your car is more than five years old.

Know more about Old Car Insurance Online.

Your NCB is your No Claim Bonus accumulated for the years you haven’t made any claims. The higher your NCB, the higher your discount during renewals. However, if you don’t renew your policy before it already expires, you lose out on your NCB and hence the discount too!

If you don’t renew your car insurance policy on time, you may be liable to pay a penalty fine as your previous car insurance policy won’t hold true after its expiry date has passed.

Apart from saving on traffic penalties and your NCB, not renewing your car insurance policy in time means you may end up losing out on money in case of an unfortunate accident or mishap. Therefore, it’s always better to be safe than sorry and get your car insurance policy renewed before the expiry date of your existing policy!

Know more about Expired Car Insurance Online.